What is Leasing?

Leasing is a broad phrase and covers a large range of products. We offer six different types of lease products that offer a broad range of options to both business users and private individuals. There are two key families of lease agreements:

Usership

These products are like a long-term rental agreement offering the exclusive use of a vehicle for a set period of time at a fixed monthly price. It offers an alternative - and often cheaper - funding solution compared to buying a new vehicle with a bank loan or dealer finance. You will never own the vehicle, only have the use of it for the period of the agreement.

Products in this family:

- Business Contact Hire (or BCH)

- Personal Contact Hire (or PCH)

- Finance Lease

- Flexible Lease

Ownership

These products also offer the exclusive use of a vehicle for a set period of time at a fixed monthly price. However, the key difference is that the customer will own or has the option to own the vehicle at the end of the agreement.

Products in this family:

- Contact Purchase

- Personal Contact Purchase

- Lease Purchase

How does leasing work?

In principle, leasing is a simple product, however each product is designed in a slightly different way to provide different benefits for different customer groups. However, the key principles remain the same.

The key elements are:

- The price paid for the vehicle

- The residual value of the vehicle (the price the leasing company predicts it is worth at the end of the contract)

- Interest charges and fees

Your rental charges are calculated on the price paid for the vehicle minus the residual value plus the interest charges, divided by the length of the contract.

For example:

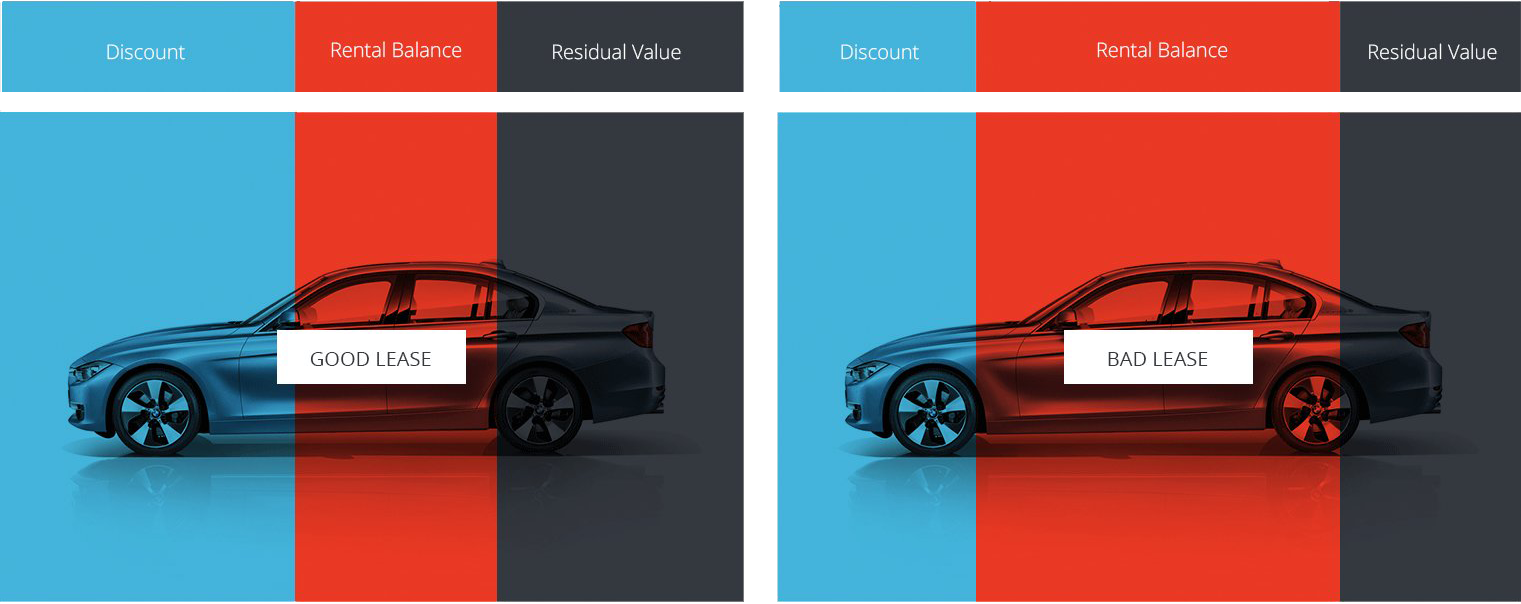

Therefore, the key to a great leasing deal is finding a vehicle with the smallest gap in price between the price paid for the vehicle and the residual value.

How do Monthly payments work?

They are a based on the total amount payable over the term and then split across the number of monthly payments you would like to make. So for example if your total payable was £4,800 and you wanted to make 24 payments over 2 years you would pay £200 a month.

However, on a lease agreement, you will make an initial payment. This can be 1, 3, 6, 9 or 12 payments or a lump sum with some finance companies. An initial payment is not a deposit, but it works in a similar way, the larger the initial payment, the lower the monthly rental. See the below examples.

When you are reviewing costs online or quotes you have been sent, it’s important to understand the effect that these initial rentals can have on the payments you are quoted. What appears to be a cheap price, may only be so due to a high initial payment. The total payable is the key amount to consider. If you’d like help comparing quotes, Call us now.

Most customers will pay either 3 or 6 initial payments. We’ll work with you to find the best payment plan for you.

The word “Deposit” is commonly used to refer to purchase products, such as Lease Purchase and Contract Purchase. However, deposits are now known as “Advance Instalment” as they are non-refundable. The key difference between an Advance Instalment and an initial payment is that an instalment is deducted from the cost of the vehicle. This means, the more you pay, the lower the amount you need to finance. So in effect, this has the same impact as increasing your initial payments on a lease product.

What makes a Special Offer?

The key to a great leasing deal is to minimise the gap between the price you pay for a vehicle and the price of the leasing company’s residual value. This is where we use our expertise and relationships with manufacturers and dealers to negotiate a range of excellent offers.

Due to the two main factors in leasing being the Purchase Price and the Residual Value, it means that you can see a big variance in rental between two very similar vehicles.

For example, you could have two similar superminis’, of the same market value e.g. £20,000. However, the monthly rentals could be significantly different. Why?

Well, it’s in either the Purchase Price, Residual Value or both.

Car A has a lower Purchase Price and a higher Residual Value.

This make the balance to finance £5,700

Car B has a higher Purchase Price and a lower Residual Value.

This make the balance to finance £9,100

It’s the difference in the balance to finance amounts between Car A and Car B that creates that difference in monthly rentals and makes Car B more expensive.

What is a Leasing Broker?

CUSTOMERS

We spend a significant amount of time to qualify customers’ needs. This ensures we are sourcing both the right financial product and right vehicle to meet your needs.

FINANCE COMPANIES

Each finance company has its own strengths and range of finance products. We work across our portfolio of finance partners to ensure we can place our customers with the right provider for their needs.

MANUFACTURERS

We work with vehicle manufacturers to acquire enhanced discount levels. We use these discounts to create special offers for our customers.

SUPPLYING DEALERS

We work with a network of reliable car and commercial vehicle dealers across the UK. We negotiate enhanced discount levels with our dealers to ensure we’re providing competitive rates to our customers. Our dealers provide nationwide delivery of new vehicles to our customers.

ANCILLARY SUPPLIERS

We work with a large array of ancillary companies to ensure your new vehicle comes with whatever you need on delivery. These ancillaries include; vehicle racking, sign writing, tow bars, van conversions and many more.